what is sales tax in tampa

31 rows The state sales tax rate in Florida is 6000. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665.

Hillsborough Could Have Florida S Highest Sales Tax After The Nov 6 Election Will It Matter

The County sales tax.

. Groceries and prescription drugs are exempt from the Florida sales tax. Florida state sales tax. The minimum combined 2022 sales tax rate for Tampa Palms Florida is.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. This is the total of state county and city sales tax rates. Hillsborough County sales tax.

Cities with the highest tax rate include Tampa. The 2018 United States Supreme Court decision in. The Hillsborough county and Tampa sales tax rate is 75.

The Florida sales tax rate is currently. With local taxes the total sales tax rate. We found that Tampas effective real estate taxes that is tax rates as a.

The Hillsborough County sales tax rate is. Several examples of exceptions to this tax are certain. In the state of Florida sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Has impacted many state nexus laws and sales tax collection. The minimum combined 2022 sales tax rate for Tampa Florida is. The 2018 United States Supreme Court decision in South Dakota v.

The 75 sales tax rate in Tampa. The highest car sales tax rate in any city in Florida is 75 the state-wide 6 plus the maximum optional local tax rate of 15. 3 rows Tampa collects the maximum legal local sales tax.

Effective March 16 2021 businesses in Hillsborough County Florida are required to adjust the sales tax rate charged on. That includes the FL sales tax rate of 6 and the countys discretionary sales tax rate of 15. This includes the rates on the state county city and special levels.

Floridas general state sales tax rate is 6 with the following exceptions. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. The Florida sales tax rate is currently.

The sales tax rate in Tampa Florida is 75. This is the total of state county and city sales tax rates. The Business Tax Division is part of the City of Tampas Neighborhood Empowerment Department and is responsible for the issuance and collection for all Business.

The proposal raises Hillsborough Countys sales tax from 75 to 85 and is expected to generate 342 million in its first full year of collection. For a more detailed breakdown of rates please refer to our table below. If the ballot passes it will.

The Tampa sales tax rate is 75. This is the total of state and county sales tax rates. The tax landscape has changed in the Tampa area.

The estimated 2022 sales tax rate for 33629 is. Contact 306 East Jackson Street Tampa Florida 33602 813 274-8211. The County sales tax.

The Florida state sales tax rate is currently. Florida collects no income tax and its state sales tax of 6 is significantly lower than any other no-income-tax state. Floridas general state sales tax rate is 6 with the following exceptions.

A State Sales Tax Of 6 And A Local Sales Tax Of 1 Are Levied In Tampa Florida Suppose The Price Brainly Com

Florida Amends Sales Tax On Commercial Real Estate Tampa Commercial Real Estate Florida Commercial Property

Eye On Tampa Bay Media Suppresses Information To Cheerlead For Vinik S 14 Transit Sales Tax Hike

Hyde Park Cafe Once One Of South Tampa S Hottest Nightclubs Is Facing 200 000 In Delinquent Sales Tax And Unemployment Tax Tampa Bay Business Journal

Amazon To Collect Colorado Sales Tax On Purchases Starting Feb 1 The Denver Post

New One Cent Sales Tax For Transportation Could Be On 2022 Ballot

Florida Sales Tax Attorney Florida Tax Litigation Attorney

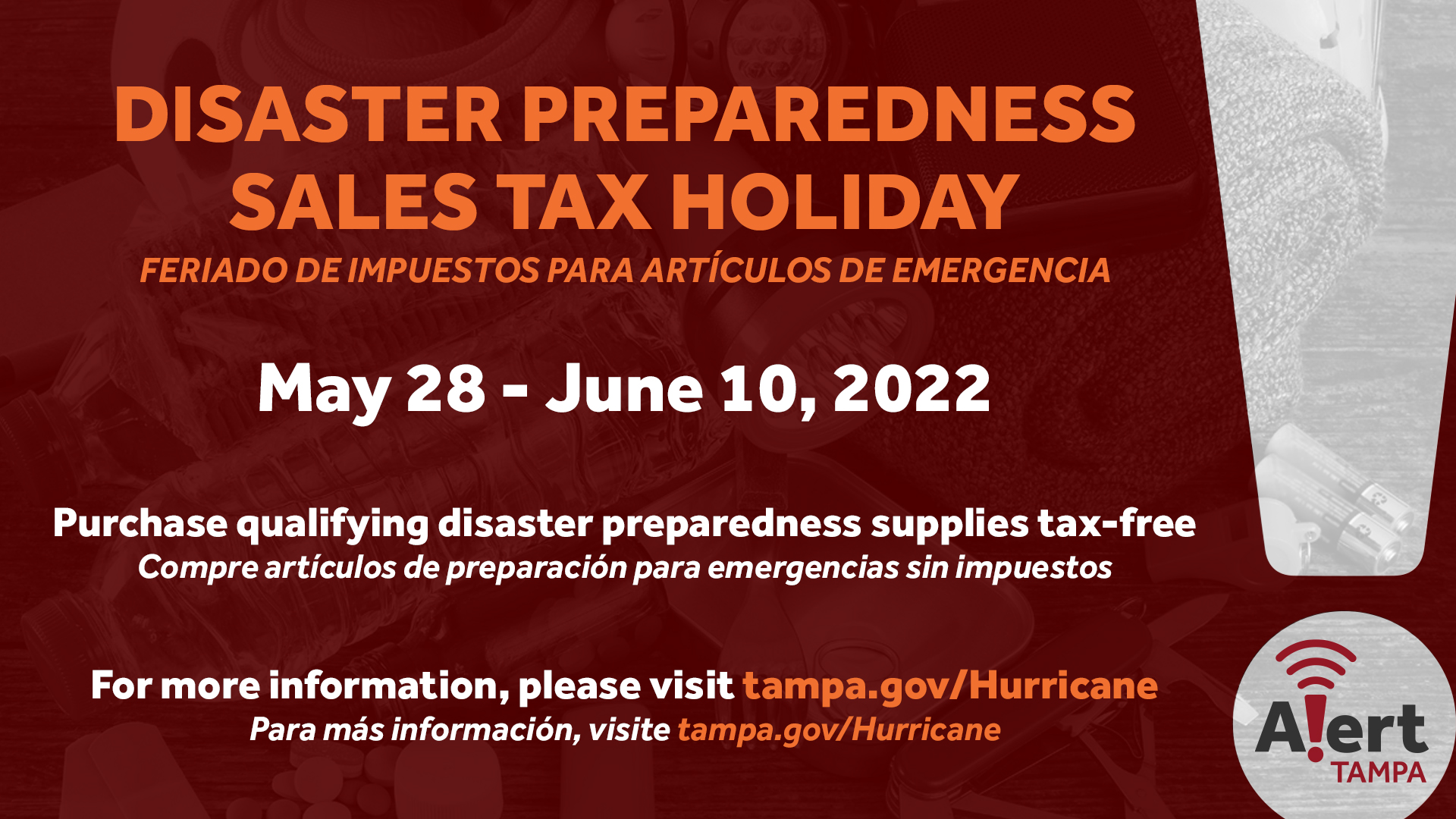

City Of Tampa It S The Last Weekend Of The Disaster Preparedness Sales Tax Holiday Ensure You Your Loved Ones Are Tampaready By Getting Items For Your Emergency Supply Kit Tax Free

Florida S 2017 Back To School Sales Tax Holiday Dates Details Tampa Fl Patch

City Of Tampa Pa Twitter The Disaster Preparedness Sales Tax Holiday Is Here Now Through June 10th You Can Purchase Disaster Preparedness Supplies Tax Free Visit Https T Co Q1blpr8myx To See A List Of

Tampon Diaper Sales Tax Exemption Moves Forward In Louisiana Legislature Local Politics Nola Com

Sales Tax No Tax For Tracks Florida

Three School Districts Make The Case For A Sales Tax Wusf Public Media

Us National Weather Service Tampa Bay Florida Starting Tomorrow June 1st Through June 7th The State Of Florida Will Be Giving A Sales Tax Holiday For Disaster Supplies The General List

Gov Ron Desantis Signs 1 Billion Sales Tax Hike On Consumers To Save Businesses Pocketbooks R Tampa

Florida S Back To School Sales Tax Holiday Begins July 25 Wfla

Eye On Tampa Bay It S A Tax Hike

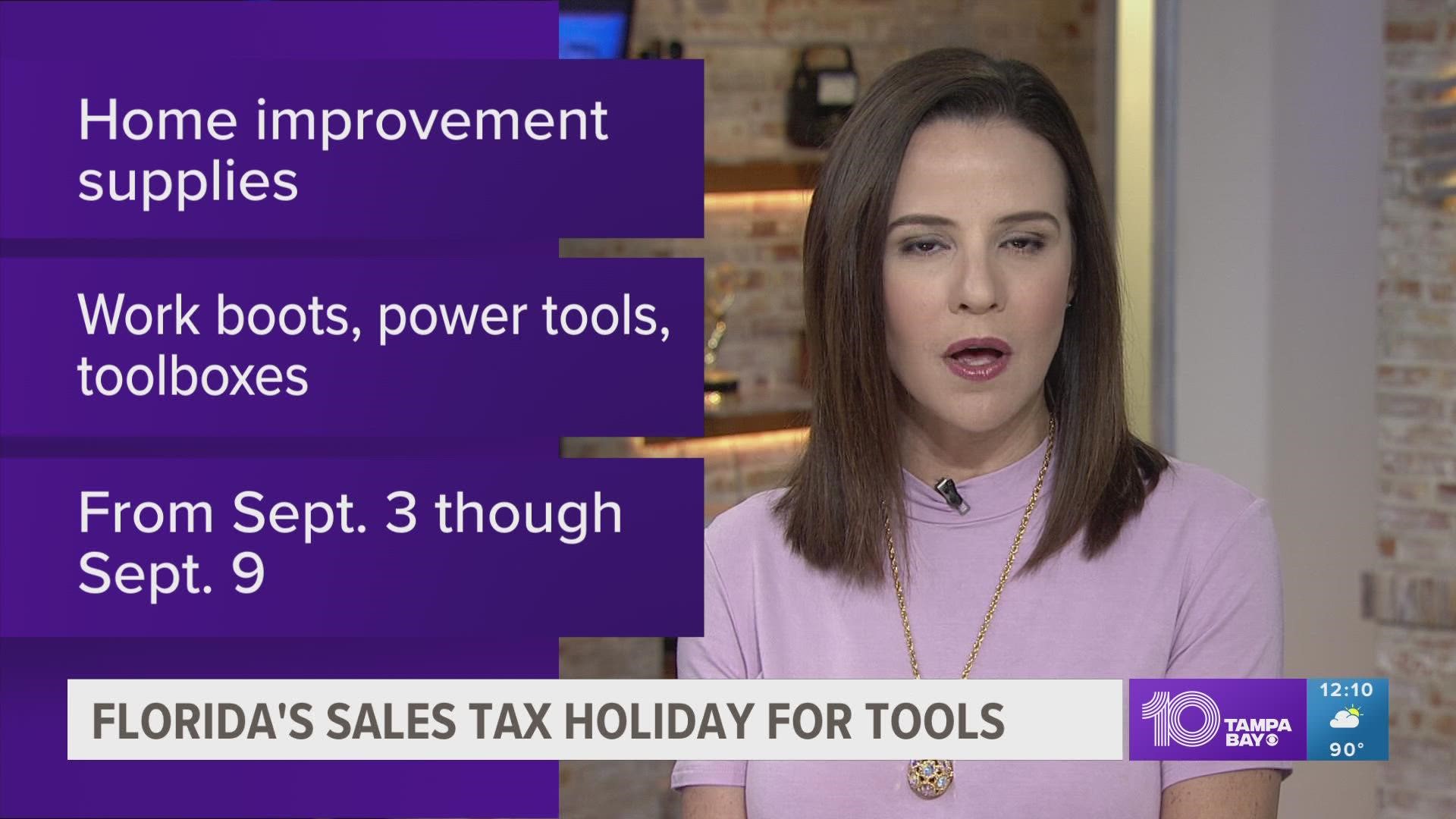

Florida Tool Time Sales Tax Holiday Starts Saturday Wtsp Com